Bloom Energy Corporation is on a roll and letting everyone know that it’s just getting started. The business is sticking to its guns with a revenue goal of between $1.65 and $1.85 billion in 2025, and so far, the figures support that. Bloom’s clean power solution is clearly gaining a lot of traction, with $326 million in Q1 and $401.2 million in Q2.

Fuel Cells and Data Centres: Powering the Digital World

What was one of the major changes this year? Bloom is getting into AI-driven energy optimisation because of a bold new cooperation with Oracle. It’s a logical move since data centres need a lot of dependable electricity and are having difficulties keeping up with the high demand, particularly in places like California where energy is scarce. As cloud computing and AI workloads grow, these facilities require electricity that is quick, reliable, and close by. That’s where Bloom’s solid oxide fuel cells (SOFCs) come in.

The modular Energy Server from the firm not only cuts down on emissions, but it can also work without being connected to the grid. That’s a major concern when uptime is not up for discussion. And now that AI is in the mix, Bloom’s performance is much better, and its efficiency is even higher in tech areas where demand is strong.

Inside the Tech

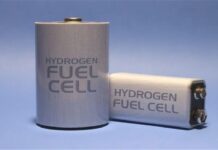

- SOFC Technology: These systems use high-temperature ceramic technology to transform fuels like natural gas, biogas, or hydrogen straight into clean power. They are noted for being very efficient, having very minimal emissions, and not needing the grid.

- Electrolysers: These devices utilise renewable energy to split water and make green hydrogen. They are based on the same solid oxide technology. That puts Bloom smack in the middle of the effort to make more hydrogen.

- AI Integration: Real-time intelligence that makes the best use of energy and distributes it in the best way. This is particularly helpful when uptime is important, and costs need to be kept low.

What’s Making a Difference

- Revenue climbed 19.5% year-over-year in Q2, and margins are trending up.

- The Oracle deal is a major gateway into the enterprise IT space.

- Bloom is shifting focus to high-margin opportunities and pulling back from older, capital-heavy setups.

- The company’s electrolyzer initiative is expanding its reach into the fast-growing green hydrogen market.

Why this is Important

Bloom’s development is wonderful for its own business, but it’s also sending a strong statement to the clean tech sector. Investors are taking attention because traditional power players that use fossil fuels are feeling the heat. Bloom is making fuel cell technology appear a lot more bankable than it did before since it has a track record of success and genuine revenue growth.

That said, things aren’t always going well. Analysts mostly think the stock will go up in 2025, but there are still some worries about the company’s financial soundness. For example, insider stock sales and a not-so-great Altman Z-score are being attentively monitored. But Bloom seems to be gaining genuine staying power with larger transactions, better cash flow, and a strong project pipeline.

The Big Picture

Bloom is doing more than just looking at quarterly performance. It’s illustrating what might happen when next-gen fuel cell technology businesses take on the two major challenges of decarbonisation and digital infrastructure. Bloom isn’t just keeping up with the energy revolution; they’re leading the way by helping to design what comes next. They have AI, fuel-flexible systems, and a footing in green hydrogen.